IoT in Financial Services

Many cybercriminals target the financial sector because of their easy access to assets and data related to those funds. One such reason is the Internet of Thing's security flaws.

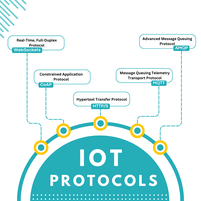

Smartphones are increasingly replacing bank tellers and connected vehicles and aiding in estimating insurance rates as IoT is put to use in today's businesses. Research suggests that insurers may utilizeIoT to examine device data to analyze risks when establishing a person's creditworthiness or that consumers may use IoT to process payments via their connected home systems.

Professionals in the financial sector must follow specific critical processes employing interconnected systems to ensure the safety of their client's data. They should begin by doing an audit to discover the current deployments and uses of Internet of Things technologies (which are frequently in places that aren't immediately obvious). Second, they should consider whether or not these gadgets need full access to the business network or whether they can execute their jobs inside a separate, quarantined area. Finally, business and technical leaders of a firm should educate themselves on a wide variety of issues, from the need for strong passwords to the best ways to silence Alexa and Siri during a company-wide videoconference.

As more and more gadgets link remotely to banking systems, applications, and data, the attack surface area grows. Almost nine-tenths of the workforce in the banking sector is worried that their company does not take data security seriously enough.

Safety may be analogized to a straight line.

Despite the proliferation of IoT gadgets and software, safeguarding a financial services firm is still an achievable goal. This is because, on average, financial services companies deal with fewer customers than other companies. According to a recent study by ABI, businesses are more aware of the need for security when it comes to managing their IoT assets.

IT security tools make it easy for workers to see what gadgets are linked to the network and to shut them off if necessary. Network and application activity analysis, virus and malware detection, and credential and access management are some tasks that modern solutions may handle automatically.

In the financial services sector, "generally it's a straight line," which is good news. You must evaluate your reach, your connected assets and devices, the significance of those devices, and whether or not your customers have access to them.

However, security is being compromised by pervasive issues across all organizations. The fact that Internet of Things devices is typically not constructed with a substantial security footprint, with minimal RAM needed to establish and maintain complete security, makes this task considerably more challenging. Because of this, it's harder to defend against cyberattacks.

The best practices to protect banks against IoT-borne threats are much the same as those for mitigating a wide range of other cybersecurity threats. Sustaining transparency, maintaining open lines of communication, and mandating basic security practices are all encouraged.

Check the stock of everything carefully

One of the most significant difficulties in guaranteeing the security of IoT in the financial services sector is determining where and how the technology is being used. The bulk of banking IoT use cases occurred where it was difficult to tell what kind of connected devices were being used for what purpose. These fields include the supply chain, trade finance, and capital goods. According to Forrester's poll, 36 percent of bank executives rate increasing operational efficiency through IoT deployment as a "high" or "critical" priority.

Financial institutions rely on a wide variety of IoT devices, not all of which were initially intended for use in banking. Adding technologies such as security cameras, door locks, video displays, printers, and more may provide criminals with a new way in. One reason is that many of these gadgets are not regarded as intelligent, and the IT department was not engaged in their installation. Moreover, there is no guarantee that these gadgets will be linked to the primary office network.

Imagine a world where there is no trust.

When safeguarding IoT beachheads in financial services organizations, one of the most critical stages is for organizations to accept that there are significantly more dangers than the security operations team is aware of. This is a crucial action for companies to take while protecting their first forays into the Internet of Things. The company will have no choice but to adopt the zero-trust cybersecurity policy. As the name implies, organizations must start from the premise that trust may only be provided after verification and authentication, rather than assuming that every given attempt to access an application, data, or service is authorized and legal. This is because authentication and verification are prerequisites to gaining someone's confidence.

Learning about potential weak points, such as Internet of Things (IoT) gadgets that haven't been updated in a while, and figuring out how to mitigate the danger they pose. He said that Hong Kong and Singapore's financial services authorities have recently updated their guidance to the banking and financial sector. For the first time, the threat posed by IoT gadgets is specifically called out in this release.

Indeed, some organizations have recently called attention to the need to include security by design in the Internet of Things gadgets. In a report published last year, the National Institute of Standards and Technology (NIST) provided basic cybersecurity standards for manufacturers of Internet of Things devices.

Communicate and educate one another

Hackers still find phishing a more straightforward information-gathering technique than getting into a bank through IoT. Even more traditional forms of fraud and financial crimes, such as money laundering, have gone digital due to the current trend toward digitization.

On Monday, it was reported that security experts and banking industry professionals are still not routinely engaging with one another, even though the intersection of fraudulent behavior and cybersecurity ought to drive collaboration among the two groups. As usual, most security companies are working around the clock to quell today's fires without disrupting their business operations.

During this time, an organization's structure's functional areas have shown the most curious about how end users interact with connected gadgets. Now, "shadow security" organizations are working inside industries due to a split between the camps. This is because these departments cannot get enough resources from the corporation to carry out their tasks.

Forrester found that the number of people choosing to work remotely because of the pandemic raised the risk of security vulnerabilities in the Internet of Things. The company's specialists recommended a two-pronged strategy for safeguarding the Internet of Things: endpoint security tools for monitoring traffic and isolating anything suspicious and employee training to raise awareness of behaviors that may reduce risk. Employees may take measures such as disabling smart speakers in the house during business conversations or creating separate networks for work and personal Internet of Things gadgets.

Professionals claim that end users' focus has shifted away from their security obligations due to the widespread availability of technological conveniences. However, this does not relieve institutions' need to inform their customers of ongoing deception efforts. Neither does it free sellers of responsibility for thorough product inspection and verification.

Explore more

Need any help in IoT?

Need any help in IoT? An Atreyo expert identify the right solution for your needs.

If ready to talk to an Atreyo expert

Interested in IoT products? go to